How to find out your customers' willingness-to-pay

[Disclaimer] This is a practical how-to guide that doesn’t provide in-depth information on the willingness-to-pay methodology & concepts as well price sensitivity research (check out this article to get to know more about it). I deliberately didn’t cover fundamentals, since there are many other sources that explain it in more detail better than I ever would. I placed some links to such materials throughout the article.

It’s always a challenge to build a valuable product, even for customer-centric companies that truly want to make a difference in people’s lives. Differentiating between what is essential to user experience & what isn’t is a challenging journey to take on.

There’s another angle to this. Assuming you know what your customers value, how can you be sure they are ready to pay for it? There’s one tool that allows you to address it — willingness-to-pay research.

Check out these materials if you want to learn more about willingness-to-pay research & pricing strategy in general: The anatomy of SaaS pricing strategy; Monetizing Innovation: How Smart Companies Design the Product Around the Price

In this article I will provide you with pointers on how to conduct the willingness-to-pay research and post-research segmentation techniques one can use to deepen their customer knowledge while maintaining the focus on monetisation.

Make a list of customer benefits

Start with enlisting customer needs/benefits you think your customers could value when it comes to your product. You can include things that your product satisfies only partially or doesn't satisfy at all, the point here is to have a list of benefits. Features are often too solution-specific, benefits, on the other side, are directly related to your customers’ needs. Here’s a great video explaining in detail how to come up with the list of customer benefits, not features.

However, if you’re really sure that your features exemplify value from a customer perspective and/or they are staples in your industry, using a list of features can make total sense.

Compose a survey

You can frame your WTP survey with 1 simple question. Here’s the classical version of it:

When it comes to Product A pricing, what would be most preferred? Least preferred?

Plan for respondent segmentation in advance

Plan your survey accounting for a future segmentation of the survey results. Answer these questions to prepare:

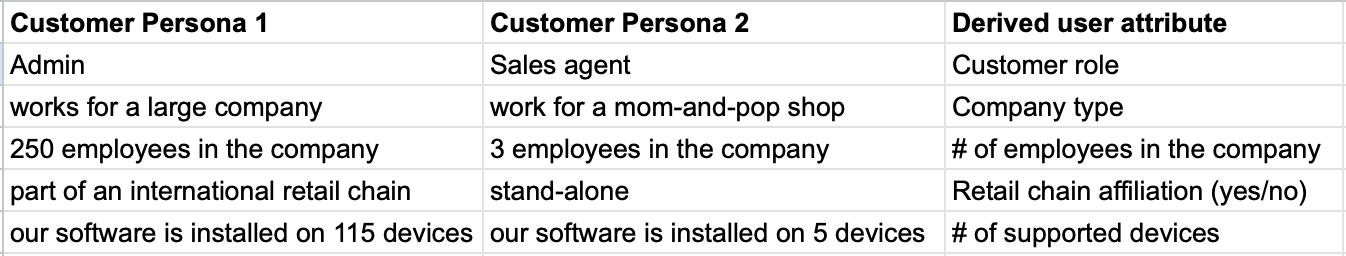

Does your product have different personas? What are the differences between them? Lay them out and use to derive a concrete list of user attributes.

What user and/or company attributes will you need to find insightful and/or meaningful differences between groups of respondents? What are your current assumptions about them?

Technically, how will you retrieve these attributes? Will you ask the survey respondents for their email and using this key merge it with the data from your DB? Will you extract respondents’ data as they fill in the survey, using such tools as Typeform hidden fields? Consult your developers on the best approach and plan for segmentation & analysis in advance.

Calculate relative preference ratios

Use (# times benefit is most wanted — # times benefit is least wanted)/(# times benefit is most wanted + # times benefit is least wanted) formula to calculate relative preference ratios.

Analyse the results & discuss them with interested parties

Stack rank benefits based on their relative preference scores. Make sure you do it for all the customer personas you have to uncover the differences between them. Invite leadership as well as people from marketing & growth departments to have an open discussion about the results. Frame it as a knowledge sharing meeting, but listen for signals of their readiness to act on specific findings.

Plan next steps

Based on the buy-in from leadership, research goals and the emerged findings, these are some ideas for the next steps:

Dig deeper into unexpected results. The WTP results’ analysis can ignite a broader conversation about what your users truly value and whether the new knowledge fits your pre-existing assumptions. If some of it doesn’t, try to understand why. You may need more research and internal discussions to find out.

Rewrite your promo & pricing materials. A quick experiment confirming or disproving your WTP research findings can be A/B testing a rewrite of your pricing page. Changing it with the WTP results in mind & tracking its impact on CR will allow you to validate customer interest even more.

Revisit your monetisation model & product development priorities. Is your current monetisation model value-based? Does it prioritise the benefits your customers are ready to pay for? Are your product development plans aligned with the WTP research findings? Ensuring these questions are addressed with proper due diligence is critical for the product success & profitability.

Let me know in the comments or DMs if/how you used/wanted to use the WTP research for your product and if it worked or not.